Will household prices freeze into the 2022?

It is difficult to help you assume what’s going to happen to home rates along side coming weeks, however study already appearing which they you’ll slip. Household cost enjoys leaped over the past two years, but there are certain points that trigger new reverse that occurs:

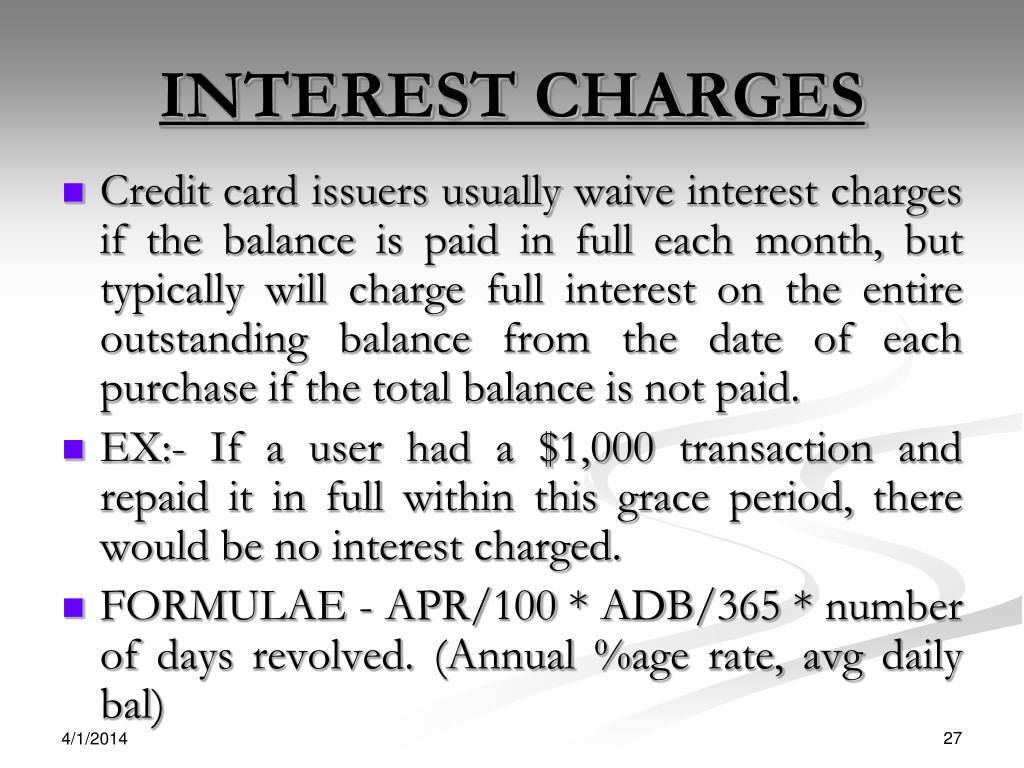

- Rates of interest have increased off their list lows from 0.1% inside December so you’re able to 2.25% today, while making mortgage loans more expensive. This may treat request however, generate borrowing more pricey for these who do prefer to follow loans Lockhart a sale.

- Following government’s questionable Sep small-finances, the lending company out-of England possess informed it doesn’t think twice to next push-up interest rates in order to rein into the higher rising cost of living and a fall regarding the value of the newest lb. It’s led to many loan providers extract mortgage purchases, then riding up rates across the board. This could even more impression need for homes and you will drop-off costs.

- Our company is inside a payment out of way of living drama given that rising prices try ascending , and make goods and services more pricey versus just last year. Over-lengthened finances suggest fewer individuals will have the ability to save enough to acquire

- Family costs flower fast throughout 2021 and may also correct from the dropping exactly as quickly

- Rising will cost you, specifically opportunity bills, may see people not be able to make mortgage repayments and need to offer right up. Casing have increase that could end up in costs to fall.

- New pandemic is not over and you may coming limitations can’t be influenced aside

Investment Business economics predicts that Lender regarding The united kingdomt would have to raise interest rates as much as step 3% to moisten rising prices, that is currently at nine.9%. But with brand new lb falling, economists state it might even arrived at six% regarding future days a shift which could create thousands in order to yearly mortgage prices.

The house or property site initial predict house price growth to help you slow in order to 5% to have 2022, however, has actually due to the fact changed this to help you 7%. It projection arrives because homes inventory is at a record lowest and that’s struggling to see consumer consult.

- Higher priced to help you borrow money

- More difficult to find an inexpensive mortgage price

If the there are a lot fewer low priced fund offered, there may be faster interest in home, causing a potential family price correction.

Some individuals, particularly very first time buyers, might possibly be in hopes domestic costs have a tendency to fall but there is however zero make certain that can come. not, a belong home costs is wanting even more likely.

Rates, which are already at the the large height once the 2008, are required to carry on to increase just like the Bank regarding The united kingdomt attempts to controls increasing rising prices and you can a-tumble on the value of the fresh lb. This may reduction rely on on the housing marketplace.

Having credit becoming more high priced, exactly how many customers could fall. As well, when the an economic downturn attacks, exactly how many providers you may drop once again also as the some body be even more risk-averse.

Certain residents are carrying out of selling on account of deficiencies in offered home buying, that is leading to the situation. Deficiency of virginia homes form buyers usually get into bidding wars to safe a house.

Financial support Economics predicts pricing have a tendency to slide 5% over the 2nd 2 yrs, however, experts from Borrowing from the bank Suisse keeps informed that it shape could be all the way to fifteen% if the rates of interest continue to go up

Experts imagine the kind of house price rises that we possess viewed over the past 18 months was unsustainable, however, no-one has actually an amazingly baseball. A dip is extremely likely from the future days if the appeal cost continue steadily to rise, however.